The Leading 2020 Presidential Candidates on Taxes

This election is a widely anticipated one, and there are a lot of huge issues on the table for discussion. However, the discussion of taxes this year is quite different and also quite essential. The candidates, ranging from far right to far left, all have very different opinions on taxes. We see candidates like Bernie Sanders calling for high taxes on billionaires, billionaires themselves running, and others who are focusing on lowering taxes for the middle class. Here we break down the major candidates and what their tax plans look like currently in this 2020 presidential election.

Republican Candidates

President Donald Trump

After his election, Trump’s administration significantly cut corporate taxes from 35% to 21%, which included a tax cut for the middle class and small businesses. However, this tax cut for the middle class and small businesses expires after eight years, meaning something new has to take place in the near future. This plan cost $1.46 trillion and also involved the following components:

- Tax cut for the wealthy

- Can only deduct $10,000 for state, local, and property taxes

- Working families receive a larger credit for child tax

- No longer required to have insurance starting in 2019

- Can pass down $22 million without paying taxes on it

- Smaller mortgage reduction

There has been talk amongst Trump’s officials that they are considering proposing a tax plan for 2020 involving a tax cut to 15% for the middle class. This would be a component of Trump’s 2020 reelection campaign, hoping to further prove that they’re not only working in the interest of big corporations. However, this is all still in early talks amongst the group. They’re also said to be discussing:

- Payroll tax cut

- Changes in taxing capital gains

- Exempting savings from taxes

- Taking the seven tax brackets to just three or four

Democratic Candidates

Former Vice President Joe Biden

Biden’s plan is more left than the president’s; however, he’s leaning less left than a good number of his fellow candidates, especially compared to those like Senator Sanders. One way he intends to tax the wealthy more is by doubling the top rate on long-term capital to nearly 40% for those who make more than a million dollars.

However, he also has a blow to middle class tax payers, as he is looking to remove the cap on Social Security payroll taxes, leaving them with a 7.65% Social Security tax on every wage they make. It’s hard to tell exactly where he stands when it comes to taxing the wealthy, but his website quotes him saying: “This country wasn’t built by Wall Street bankers and CEOs and hedge fund managers. It was built by the American middle class.”

Biden also stands suspiciously on the S Corporation Payroll Tax Opportunity, as he used the current tax rates himself to save quite a bit of money on his taxes, so it’s hard to say where he may stand on this. However, it’s pretty standard among Democrats right now to propose removing this opportunity for the wealthy.

He has also proposed a $1.7 billion investment for funding more environmentally friendly energy sources and infrastructure improvement by reversing some of Trump’s 2017 tax reform. He also supports a few tax credits for caregivers, children, and small business for their employees’ retirement plans. He has not revealed much about how he will fund these tax reforms, but he also seems to have less programs to fund than some of his other fellow candidates.

Senator Bernie Sanders

We then turn to the most left leaning candidate in the 2020 race, Senator Bernie Sanders. He’s known for his tough policies regarding taxing billionaires, but he also faces backlash against his plans which involve raising taxes slightly – for the purpose of introducing or rebuilding programs to help maintain the life, liberty, and happiness of citizens.

He’s the largest proponent of Medicare for all, and all candidates seem to be basing their plans according to his, whether leaning left with him, or remaining a centrist option. Sanders is not afraid to say that taxes will probably raise for the middle class, especially as his other reigning plans include making public college free, improving Social Security benefits, and supporting the Green New Deal.

His tax on the extremely wealthy includes a tax on those whose net worth exceeds $32 million, hoping to receive over $4 trillion from billionaires and cutting their net worth in half over the next 15 years. He’s said his strong opinion that, “We need real tax reform which makes the rich and profitable corporations begin to pay their fair share of taxes. We need a tax system which is fair and progressive. Children should not go hungry in this country while profitable corporations and the wealthy avoid their tax responsibilities by stashing their money in the Cayman Islands.”

Forbes.com provides an idea of what his proposed tax rates would look like:

| Income | Current Rate | Sanders Rate |

| $0 – $9,525 | 10% | 10% |

| $9,526-$38,700 | 12% | 16% |

| $38,701-$82,500 | 22% | 26% |

| $82,501-$157,500 | 24% | 28% |

| $157,501-$200,000 | 32% | 36% |

| $200,001-$250,000 | 35% | 39% |

| $250,001-$500,000 | 35% | 44% |

| $500,001-$2,000,000 | 37% | 44% |

| $2,000,001-$10,000,000 | 37% | 54% |

| over $10,000,001 | 37% | 70% |

Other components of his plan include:

- Splitting Social Security tax in half again once it’s reached $250,000

- 7.5% payroll tax on employers after the first $2 million

- Make the maximum amount of itemized deductions at 28%

- Applying the self-employment tax to S corporation incomes

Senator Elizabeth Warren

Warren states her goal is “to tackle the corruption in Washington that makes our government work for the wealthy and well-connected, but kicks dirt on everyone else.” She proposes an Ultra-Millionaire Tax, which would apply to those with $50 million or more, charging them a two percent tax on each dollar after that $50 million and a six percent tax on each dollar once they exceed $1 billion, bringing in almost four trillion dollars for the government to spend in the next ten years.

She also would implement a net investment income tax of an additional 14.8% at $250,000 for singles and $500,000 for those filing as married. Along with this would be a 14.8% tax split by employers and employees after $250,000. Like Bernie and most other Democrats, she also votes to close the S Corporation Payroll Tax Opportunity.

Something different about her corporate taxing policy is that she looks to tax on the income that is reported to a company’s shareholders versus their taxable income. Overall, Warren has been a little vague about what her tax plans would mean for non-billionaires or corporations, and dances around the idea of raising taxes for middle classes, despite having several social plans similar to Sanders’ that need funding.

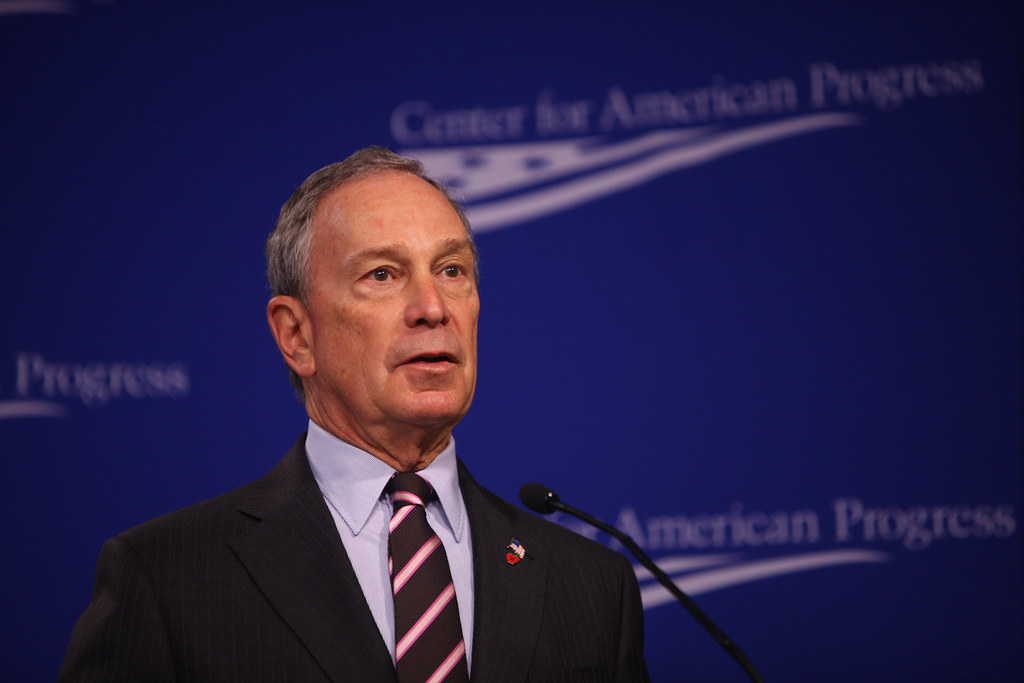

Michael Bloomberg

Mike Bloomberg is an interesting candidate for this batch of Democrats, as he is a billionaire himself. So where does he stand on tax reform? One thing we know for sure is that he doesn’t agree with his more left fellow candidates and their desire to heavily tax the wealthy upon their election, but does agree that taxes being raised sometimes works out.

As far as the rest of his policy’s he hasn’t said too much yet. Recently, he revealed his plan for increasing tax credits for earned income and child care in order to help those holding down a job but still making a low-income. However, he didn’t state by how much.

His website talks a lot about what he did as the mayor of New York and how that will be reflected in a Bloomberg presidency. As far as his economic principles go, he says he “helped raise incomes for working families, created local tax credits to boost earnings, expanded access to public health insurance, and connected more people with career opportunities.” So we can assume that his tax plans will have those goals in mind.

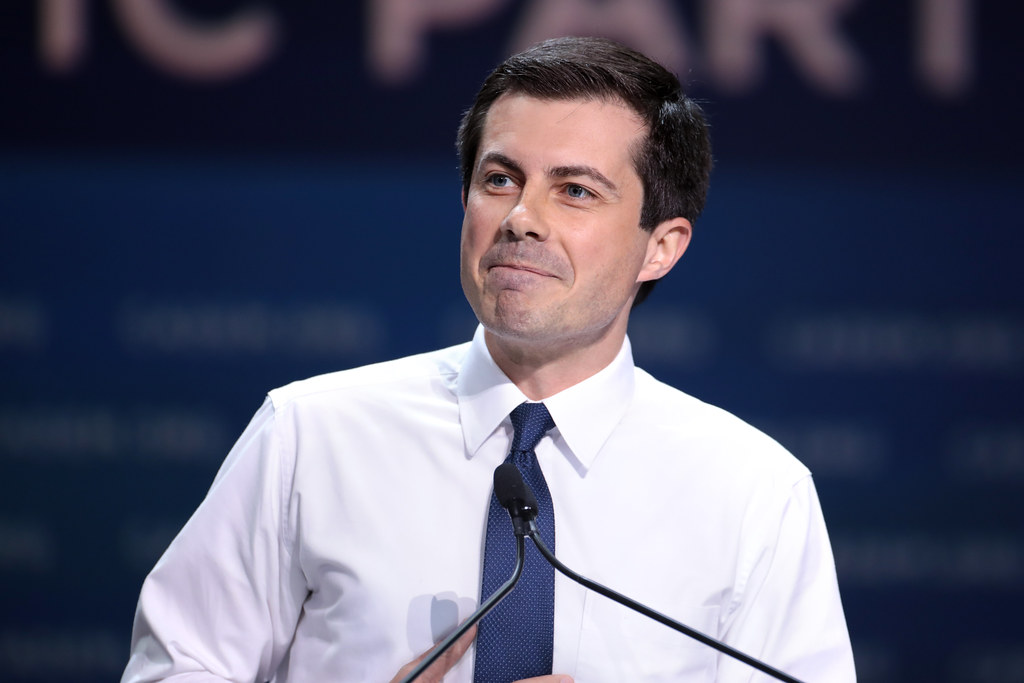

Mayor Pete Buttigieg

Running as a more centrist candidate among this particularly left crowd, he does look to reverse Trumps’s tax reform from 2017 and raise taxes for the wealthy, versus a total reform of the system. This is another candidate that hasn’t said a whole lot about their tax plans compared to those who make it a large part of their campaign. He does, however, support Medicare for all who want it, claiming he has more realistic goals about what the American people can and can’t truly afford when it comes to creating social benefit programs.

He also agrees with raising taxes for the wealthy, as “Some people frankly are getting a bit of a free ride on the productive energy of this country and this economy,” according to Buttigieg. However, again, he doesn’t believe in this as intensely as some of the other candidates and doesn’t look to raising them quite as much.

He does seem to focus a bit more on expanding the capitalist system we have now into something that’s more efficient, contrasting against some of the candidates who claim the whole system is flawed. He believes that, “The thing that makes capitalism capitalism is competition. But as you have more and more corporate agglomerations of power, you’re going to see less and less competition.” In a Buttigieg presidency, we’ll probably see tax and economic reform that looks more at how to increase everybody’s function and contribution to society, and ensuring that there are more equal results.

Andrew Yang

This candidate has largely run on his Freedom Dividend, a monthly $1,000 given to all Americans over the age of 18, free of charge. He’s really the finance guy in this race, with a comprehensive background in mathematics. He does include some similar plans to his fellow candidates, such as Medicare for all, but overall is looking to rebuild Human-Centered Capitalism. He says that, “the focus of our economy should be to maximize human welfare. Sometimes this aligns with a purely capitalist approach, where different entities compete for the best ideas. But there are plenty of times when a capitalist system leads to suboptimal outcomes,” mostly referring to the way the system caters to billionaires and corporations.

He plans on funding his ideas with a Value-Added Tax of ten percent, a tax applied to every part of the process of making a product. This is something already common in most countries throughout the world, and his ten percent proposal is half of what is currently being charged in Europe.

Overall, there is a wide range of candidates running in this 2020 election, and they all have similar ideas, but tend to differ quite greatly. It looks like your options will either be: farther left with higher taxes on the wealthy and a slight raise for middle class, counteracted by the savings of health care and other burdens; centrist with a slightly higher tax on the rich and not too much change for middle class; or more right, involving tax breaks for corporations and hopefully a decrease in taxes for the middle class.