Everything You Need to Know About Paying Your Taxes

Two things are certain in life, as the old saying goes, death and taxes. Life prepares us reasonably well for death; we all know what it is and how it happens, at the very least. The same cannot be said for taxes. Often, we are thrown straight out of school into the big, bad real world without a clue about taxes, loans, mortgages, or anything in between.

This leads to a massive problem because, if school hasn’t taught you about taxes, then who can? Well, that’s what this article is for. We’ve all been here at one point – new to the working world, fresh and budding with excitement, but also ignorant.

The good news is, though, that it isn’t as intimidating a topic as it might first seem. True, mention taxes and most people groan with displeasure, and images of forms and empty bank accounts are conjured up in people’s minds.

It doesn’t have to be such a negative experience, though. At the very least, you can try to minimize the agony with a little education and preparation. It isn’t the bureaucratic behemoth that you might think it is, and calculating and filing your taxes can be relatively straight forward.

Most people set aside a day or two each year to get all of their tax-related work and calculations done, but most don’t leave the money aside, meaning they end up paying their entire bank account at the time in taxes. You can take this approach too if you want, but you’re better off putting money aside each payday to prepare for paying taxes.

Here is everything you need to know about taxes as a beginner.

Tax Terminology

Before we go head first into the nitty-gritty of it all, we’re going to have a look at some terms and phrases that you should be familiar with. A lot of these are going to be new and intimidating, but the more you familiarize yourself with the tax system, the more trivial this should all seem.

Tax Bracket

This specifically relates to income tax. In the American tax system, as well as that of most of the wider world, the more you earn, the more you pay. It’s a simple concept. The brackets are divided by a percentage of earnings. There are two brackets, one for if you’re married and one for if you’re single. We’re going to be using the single bracket for most of our examples. So say, for instance, you work one day per week and make $8,000 dollars per year. That money is taxed at 10% percent. Whereas if you made $20,000 dollars, that would be taxed at a higher percentage. There is one caveat to all of this that you need to wrap your head around, though.

Marginal Tax Rate

The marginal tax rate is that caveat that you need to figure out. It confuses many at first, but it’s easy to understand once you comprehend it. First, let’s start with the misconception. These are not the actual brackets, but for convenience’s sake, we’re going to use them. Say you make $50,000 dollars per year. Then say that income is taxed at 10% percent for $10,000 dollars and 25% percent for up to $55,000 dollars. You assume that you just pay 25% on your earnings, right? However, instead, you pay the percentages starting at the lowest bracket. So you would pay 10% percent on the first $10,000 dollars that you made and then pay 25% on the remaining $40,000. It’s a complicated concept, but it makes sense in time. That’s the concept, but the actual definition of the marginal tax rate is the rate paid on your last dollar earned, so it’s the highest tax rate that you pay. In the above example, it would be 25% percent.

Effective Tax Rate

Your effective tax rate is the average percentage that you are paying. You add the percentages that you fall under and divide by the number of percentages to get the average percentage that you’re going to be paying in tax.

Tax Breaks

Luckily for you, the government, for all its evil ways, is relatively fair when it comes to taxes. There are several situations and reasons that would allow you to claim back or hold onto that taxable income. In fact, there are three specific ways: deductions, exemptions, and tax credits.

Tax exemption is the name given to a set amount of earnings that you get to deduct from your taxable income. It’s essentially a chunk of cash that you don’t have to pay tax on. There are two types of tax exemptions: personal and dependent.

Personal tax exemptions apply to those who aren’t married, have no kids, and are independent, meaning that you aren’t down as a dependent on your parent’s tax forms. If you’re married, both you and your partner can apply for a personal tax exemption, even if you’re filing your taxes together.

Dependent tax exemptions is an exemption given to you for each person that you need to support financially. This is typically in the form of kids, but in specific scenarios, other family members can also fall under this umbrella.

There is a limit on how much you can earn to claim exemptions, and once you pass that limit, you’re no longer able to. That amount is typically quite high, though, so if you’re just starting out, you don’t really have to worry about that.

Tax deductions relate to a specific expense that you’ve had to pay throughout the year that the government allows you to subtract from your taxable income. For example, you can deduct that interest that you have had to pay in student loans from the amount you have to pay in tax.

There are two types of tax deductions: itemized deductions and standard deductions. A standard deduction is a set amount determined by congress that you can take out of your taxable income.

An itemized deduction only applies if you don’t take the standard deduction. With this one, you create an itemized list of everything you spent money on that can be used as a tax deduction, add up the amount, and then take that out of your taxable income.

Whereas tax exemptions and deductions come out of the money that can be taxed, a tax credit comes out of the tax that you are already paying. There are a few different tax credits out there, but essentially, it is a criterion that allows you to retain an amount of money that you would otherwise be paying in tax.

Withholding Allowances

When you get paid, your employer holds onto a certain amount of your paycheck that you owe in taxes in order to pay the IRS. This is standard, but you can actually control how much or how little your employer is allowed to withhold with a Form W-4. There are advantages and disadvantages to each, but as a rule of thumb, you should probably let your employer pay the income tax for you, withholding what is needed by the IRS.

Adjusted Gross Income

Your adjusted gross income is the amount that you earn after certain expenses, like student loans, are subtracted. Your taxable income is then calculated by taking your adjusted gross income and taking out and deductions or exemptions.

Paperwork

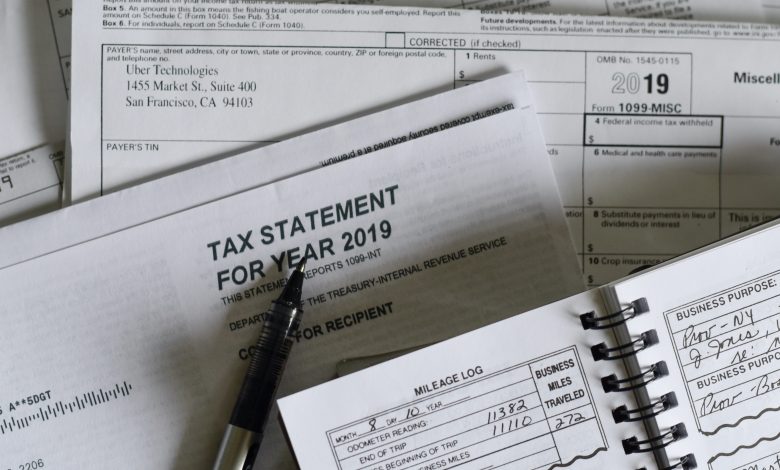

Tax-related paperwork can be an absolute nightmare, and while the invention of new computer programs cuts down on this significantly, there are still a lot of physical forms you’re going to be handling. To try and organize this the best you can, get yourself a folder and organize your forms accordingly as each one comes in the mail.

The forms that you get in the mail depend entirely on your situation. In terms of income, there are a few primary forms that you need to be familiar with:

- W-2: A W-2 form is the standard form that most people receive from their employer automatically. It outlines how much money you have earned, as well as how much income tax your employer has withheld from your paychecks.

- 1099: A 1099 is related to extra-curricular income made that isn’t coming from an employer. If you’re a contractor or a freelancer, then you’re going to need this form, as it is used to report the income you’ve made from those sources.

- 1099-INT: A 1099-INT is another form related to extra income. In this case, it is related to interest earned on a savings account. A 1099-DIV is pertaining to any dividends you have received as the result of investments.

- 1099-B: Lastly, a 1099-B details any brokerage trades you’ve made, including stocks or bonds.

When it comes to outgoings and expenses, there are two more forms that you need to familiarize yourself with:

- 1089-E: A 1089-E details any interest that you have paid on student loans throughout the year.

- 1089: A 1089 outlines the interest you have paid on mortgage repayments.

You’re also going to want to hold onto any documents that detail and charity contributions, medical bills, or retirement fund contributions.

That’s the documentation that you’re going to need, but now you have to move onto the forms that you actually need to file your taxes. Keep in mind that, in this day and age, you’re better off filing your taxes online using one of countless different tax calculating softwares. All this software is based on the following paperwork, though.

The standard form that the majority of people are going to be using is known as a 1040. This form includes all of the essential information that the IRS is going to need from you, including your address and date of birth, your dependents, what type of deduction you’re claiming, and your filing status.

This is the foundational form, but there are addons that you need to submit with this called schedules.

- Schedule One needs to be filed if you’re claiming certain deductions, such as the student loan deductions. You also need to file this schedule if you have requested unemployment benefit, have prize money or gambling winnings, or capital gains.

- Schedule Two needs to be filed if you owe alternative minimum tax, which chances are you don’t.

- Schedule Three must be submitted if you claimed a non-refundable tax credit besides the earned income tax credit.

- Schedule Four is if you owe tax on things besides self-employment and tax on withdrawals from something like a 401(k) account.

- Schedule Five is about claiming credits other than an additional child tax credit or American opportunity credit.

- Schedule Six is for if you have a foreign address or if a third party is filing your taxes for you.

There are also different types of a 1040 that you need to be aware of: the 1040EZ and the 1040A. On top of all of this, each state also has its own tax forms that need to be submitted, so you’re going to need to learn about your state’s forms as well.

That’s a whole lot of paperwork and a lot of technicalities like different exemptions and credits. If we were to list them all off, you’d be here all day. So instead, when you’re filing your taxes, research the credits and exemptions that you are entitled to in your state. Focus solely on the ones that apply to you, instead of the million and one obscure payments and technicalities.

How to File Your Tax Forms

There are three ways to file your forms. Each has its advantages and disadvantages, but there is one obvious way that stands out above the rest, and that is to file them online.

E-filing your taxes is the recommended route you take for a variety of reasons. It’s faster, easier, and you’re less likely to make any errors or mistakes when you do it this way. There is a caveat here, and that is that, if you earn more than $66,000 dollars, chances are you are going to have to pay for one of these programs. If you don’t, however, the IRS has a list of tax filing programs that you can take advantage of for no charge at all.

Not only do these programs allow you to file your federal taxes, but most even allow you to apply for your state tax returns. On top of that, the program can even help you identify what returns you’re eligible for based on a series of questions it should ask you.

All in all, e-filing is the way to go, even if you do have to pay a fee for the program. It’s faster, easier, walks you through the entire process and is going to save you one hell of a headache.

However, many people would advise that you file your taxes the old-fashioned way at least once in your life. Doing this affords you a much greater opportunity to learn about the tax system and all of the ins and outs regarding certain exemptions, deductions, and things of that nature. The IRS even provides an instruction book that is full of information that you may find useful regarding tax regulation, codes, and anything else you could ever need to know about taxes.

You can download the forms you need from the IRS’ website. Once you do that and fill them in, you can find the address you need to send the forms to on the same website, as the address varies from state to state. Keep in mind that it can take upwards of two months sometimes for your physical forms to process, meaning there is going to be a significant delay on any tax returns you’re owed.

Lastly, you could have a third party submit your forms for you. There are volunteer tax services around the country dedicated to helping people fill out their tax forms that you can take advantage of, or you could pay a professional to do it for you.

Tax Filing Status

We mentioned a tax filing status earlier as a part of your 1040 form, but you may be wondering what that means. Well, it is literally your status. There are a few categories that you can fit into.

Single

This one is relatively self-explanatory. You can file as single if you’re divorced, widowed, or have never been married in the first place. You’re better off applying as single only in that last case scenario, as there are special statuses relating to the other two.

Head of a Household

You are able to apply as head of a household if you aren’t married, pay at least half of the cost of maintaining your household, and are living with a person that you financially support. There are a few criteria that designate a person that you financially support that you can find online, but your children are the obvious example.

Married

You can apply as married if you are, well, married. There are two ways to file your taxes if you’re married, separately or jointly. There are limits on things like deductions if you do decide to file separately, so in most cases, married couples are better off filing jointly.

Widowed with a Dependent child

There are a few criteria you must fill in order for you to file as a widow or widower. Firstly, your spouse must have passed away in the last two years. Additionally, you must have been eligible to file your taxes jointly with your spouse for the year of their death, be maintaining a household with at least one dependent child, and haven’t remarried.

Standardized or Itemized Deductions

A question that most people ask when they first file their taxes is whether they should take the standard tax deduction or the itemized one. The deduction makes up a large chunk of money, and often the difference between your itemized entitled amount and the standard amount is significant, so it’s worth giving this some thought.

Standard deduction changes from year to year and also depends on the status under which you are filing your taxes, so look up what the brackets are for the year that you are filing your taxes to see how much you’re entitled to under the standardized amount.

Generally speaking, most people go for the standardized option. You might think that’s because it’s easier, but the main reason is that people’s itemized amount is actually smaller than the standardized amount. So you should only be applying for the itemized deduction if that amount exceeds the standard amount that you are entitled to.

There are a bunch of things that you can claim under itemized deductions, so do some research and some calculations and add it all up if you think that your itemized list might be greater than the standard amount.

Tax Deadlines

Taxes are filed for the year before, obviously, so you can start filing your taxes as early as the end of January most years.

April 15th is typically the deadline for taxes, and as such, has taken on the name of Tax Day. If the 15th falls on a weekend or a holiday, it moves to the next business day. Regardless, that should be the deadline that you keep in mind, so make sure your taxes are all filed before that date.

Audits

One other thing that we have to mention with regards to taxes are audits. An audit is when the IRS comes knocking to make sure that you qualify for all the things you claim for and that you file for the right amount of earnings. It’s the reason you want to keep all your paperwork together. The chance of you being audited is only around half a percent, but if you do get audited and don’t have your stuff together, you’re in for a world of hurt.