Taxes

Paying taxes is never a fun chore, and it’s hard to know whether you’re going to owe money, be in the clear, or get money back. RateRush.com has all of the information to look for when you’re trying to complete your own taxes, as well as how to budget leading up to them and make the best decisions when filing. We’ll keep you informed on changes in the current tax system, things you should be aware of, how to choose an accountant to file for you, and anything else you may be looking for.

-

Work From Home Tax Deductions That You Can Claim

At home businesses have many advantages over their brick-and-mortar counterparts. For a start, entrepreneurs save money on gas and office rent. Similarly, freelancers that operate online enjoy unique benefits in comparison to employees who commute to a physical office location. However, transportation costs and rent are on the tax deductible expenses list of traditional businesses, but not digital ones. Nonetheless,…

Read More » -

Last Minute Tax Tips before the April Deadline

Just in case you haven’t been paying attention to any breaking tax news, we have a list of top tips that could save you a large sum of money.

Read More » -

How to File a Prior Year Tax Return

Filing late taxes does not have to be a scary project. With a few focused hours of work, most late and prior year taxes can be filed

Read More » -

The Leading 2020 Presidential Candidates on Taxes

This election is a widely anticipated one, and there are a lot of huge issues on the table for discussion. However, the discussion of taxes this year is quite different and also quite essential. The candidates, ranging from far right to far left, all have very different opinion on taxes. We see candidates like Bernie Sanders calling for high taxes…

Read More » -

Part Three: Preparing for Inflation-Adjusted Premiums

In January, your tax credits and average health insurance cost, per month, are going to change. Whether it’s a private plan, an employer-sponsored one, or Medicare, all consumers’ income brackets are going to be adjusted for inflation. In short, if your household earnings go up, your premiums might not because of the higher income brackets. Moreover, consumers may even qualify…

Read More » -

Part Two: Inflation and Your Health Premiums

Generally, the government takes care of a portion of your health insurance premiums. The amount is based on someone’s income bracket, which changes every year because of inflation. In a previous article, we discussed how this impacts the average monthly health insurance cost, even if a household’s income doesn’t go up or down. The change will effect the 2019 Medicare…

Read More » -

The Best Online Budgeting Tools for Taxes

In a previous article, we outlined the advantages of using online budgeting tools for your taxes. We also discussed how the IRS customer service team may offer free support and guidance. These different tax-preparation methods can save you plenty of money and time, while enabling you to discover new deductions and credits. Some of the most prominent apps include PocketGuard,…

Read More » -

The 2020 Inflation Adjustment and Your Health Premiums

Starting next year, inflation will impact the average monthly health insurance cost and the Medicare premiums 2020 rates. More specifically, even if your income doesn’t change, inflation might diminish your taxable earnings. In turn, you may qualify for lower premiums and tax savings. Having said that, higher health insurance options are also on the table. If your income increases, so…

Read More » -

The Hidden Burden of Sales Taxes

Imagine that you’re in line at the grocery store. As the cashier rings up the other customers’ items, their total payment and sales taxes show up on the register. Meanwhile, when it is your turn, the checkout employee deducts your taxes or refunds you the amount in cash. If you happen to live in one of the states with no…

Read More » -

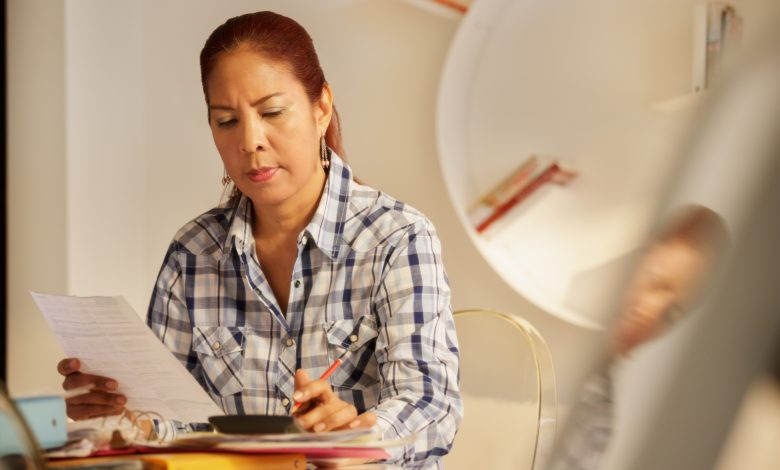

Efficient Tax Planning: How and When You Should Do It

Two years ago, the Republican-controlled United States Congress passed the Tax Cuts and Jobs Act. The law, which President Donald Trump signed into effect, made filing taxes easier and simpler. Even more so when we consider the already existing online tax-preparation software, alongside some handy IRS customer service features. The picture, however, isn’t as rosy as it looks. In 2019,…

Read More »