Taxes

-

Budgeting

Jobs Are Going Remote, and It’s Great News for Everyone

Some states are offering big bucks to remote workers willing to make the move.

Read More » -

Taxes

Last Minute Tax Tips before the April Deadline

Just in case you haven’t been paying attention to any breaking tax news, we have a list of top tips that could save you a large sum of money.

Read More » -

Budgeting

Simple Tips for Saving

Read on for a few tips that can give you the start you need and help you ensure that the wealth you need is attainable.

Read More » -

Home Buying

How Much Home Can You Afford?

When you decide that you are ready to buy your first house you need to understand what your budget is going to be. This can get you on the road to purchasing your home by searching in the right market before you have to finish your mortgage application.

Read More » -

Loans

A Business Loan vs. Grant: Which One?

When looking for solutions, every business owner and entrepreneur knows that there is no one-size-fits-all approach. Each entity is unique, and their approach depends on their industry, size, business model, location, and structure. However, every company needs capital and funding in order to grow. Some firms are able to qualify for a private or federal small business grant. Others, meanwhile,…

Read More » -

Taxes

The Leading 2020 Presidential Candidates on Taxes

This election is a widely anticipated one, and there are a lot of huge issues on the table for discussion. However, the discussion of taxes this year is quite different and also quite essential. The candidates, ranging from far right to far left, all have very different opinion on taxes. We see candidates like Bernie Sanders calling for high taxes…

Read More » -

Budgeting

Part Three: Preparing for Inflation-Adjusted Premiums

In January, your tax credits and average health insurance cost, per month, are going to change. Whether it’s a private plan, an employer-sponsored one, or Medicare, all consumers’ income brackets are going to be adjusted for inflation. In short, if your household earnings go up, your premiums might not because of the higher income brackets. Moreover, consumers may even qualify…

Read More » -

Budgeting

Part Two: Inflation and Your Health Premiums

Generally, the government takes care of a portion of your health insurance premiums. The amount is based on someone’s income bracket, which changes every year because of inflation. In a previous article, we discussed how this impacts the average monthly health insurance cost, even if a household’s income doesn’t go up or down. The change will effect the 2019 Medicare…

Read More » -

Budgeting

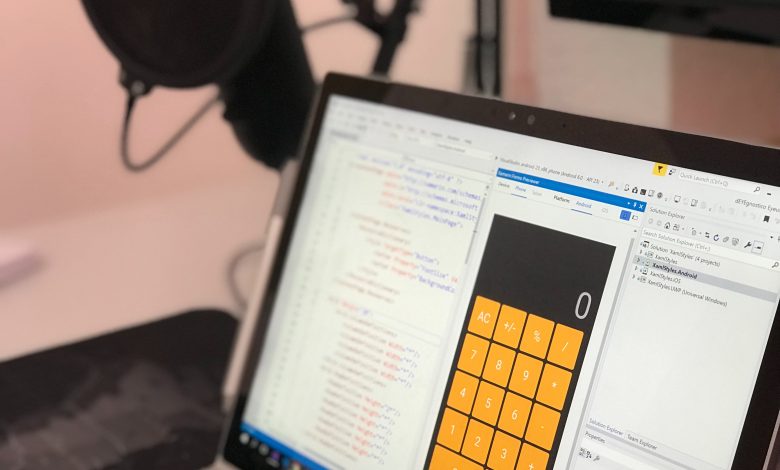

The Best Online Budgeting Tools for Taxes

In a previous article, we outlined the advantages of using online budgeting tools for your taxes. We also discussed how the IRS customer service team may offer free support and guidance. These different tax-preparation methods can save you plenty of money and time, while enabling you to discover new deductions and credits. Some of the most prominent apps include PocketGuard,…

Read More » -

Investing

Five Reasons to Invest in Real Estate

Investing in real estate means that you purchase a future income stream from a property. You probably don’t realize that you could be earning money at the same time as using renter’s money to pay off your investment. By doing this, you’ll get more stability, higher returns, and diversification. Investing in real estate is especially beneficial if you’re about to…

Read More »