The Risks of Investing Your Life Savings

Investing one’s life savings in a portfolio is considered common knowledge. The growing use and popularity of online brokerages that offer an endless amount of stocks, bonds, mutual funds, ETFs, and cash accounts seems to confirm the belief that a person is being wise investing and making their money “work for them.” However, the entire business of using one’s life savings as an investment has several serious flaws that this article will dive into.

The Modern Portfolio Theory

The core problem of investing as it is currently understood is that all, or nearly all, of a person’s life savings, should be invested in a portfolio. Depending on the age and goals of the investor, it determines how much money should be invested in cash accounts, stocks, and bonds. These portfolios of people’s investments work on a principle known as the Modern Portfolio Theory that was pioneered by Harry Markowitz in 1952. His work was considered so innovative that he was awarded the Noble Peace Prize in 1990.

Everything in modern retail investment runs on a version of the Modern Portfolio Theory. Brokerage behemoths like Charles Schwab, Fidelity, and Edward Jones offer customer-tailored securities of mutual funds, ETFs, stocks, and bonds that use the Modern Portfolio Theory as the foundation for investment decisions.

Before going into the problems with the modern investment philosophy, it is important to understand that the Modern Portfolio Theory rests on two foundational assumptions. First, diversification reduces a portfolio’s risks. Second, the fact that a diversified portfolio, on average, will increase with the market over time. These two assumptions have cost savers trillions of dollars in losses since these methods were employed. Worse, they will cost investors trillions more in the future.

So why is the Modern Portfolio Theory problematic? It’s because it makes mistakes about the nature of risk. Risk is everything for the investor, as it decides if a person can retire successfully and comfortably.

The Modern Portfolio Theory rests on the idea that an entire life savings can be invested in a diversified portfolio. This diversification is meant to mirror the diversity of the market itself. As the market has always gone up over the past century, diversification allows the investor to have some parts of the portfolio do poorly, but be compensated by gains in other parts of the portfolio. Over time, the portfolio should track the gains of the stock market. An eight percent return is considered the average yearly gain for the stock market for the past 100 years.

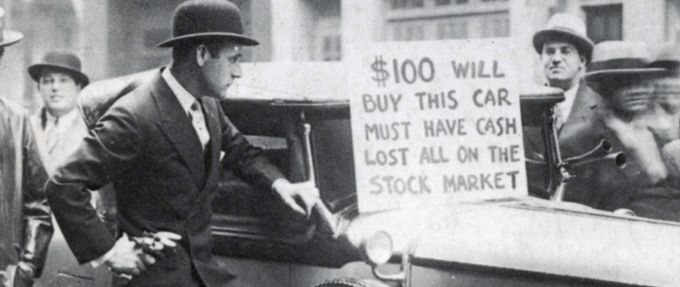

It is empirically true that the stock market has risen on average eight percent, but there have been plenty of times that the market crashed. It is assumed by modern finance that diversification will protect a portfolio from losses during a crash, and as long as the investor stays invested, those losses will be canceled out by gains after the crash. Again, this might be true of the entire investment community as a whole, but averages mean little to investors that watch their life savings of a million dollars drop to less than $100,000.

Financial Crash of 2008

This is exactly what happened in the financial crash of 2008. The market, the entire investment and financial systems of the world, collapsed in unison. There were no assets that survived the collapse. Stock, bonds, and treasuries all collapsed together. Diversification proved that it did not work if everyone tried to sell everything at the same time.

What compounded the crash is that many people had other assets collapse along with portfolio assets. Housing values in the United States cratered, many lost jobs, and all of a sudden investors realized they needed to sell their portfolios if they were going to have any chance of paying the mortgage and surviving. The problem was that often their portfolios had fallen by fifty percent or more, and they were forced to take what they could get in an effort to pay the bills.

The people that sold did not get to enjoy the gains that came after the crash, but it hardly mattered, as they sold in an effort to save what they could from the burning financial system.

In short, the averages that the Modern Portfolio Theory uses mean nothing to the individual investor if it means they lost everything.

Using the financial crash of 2008 as an example of how the diversification did nothing to stem the losses of portfolios, let’s take a moment to explore an alternative option.

Less Risky Investments

The idea of investment in financial markets is to gain about eight percent per year in returns. However, what is the point of risking everything to make just eight percent? There may be small amounts of money to be made in the stock market, but it comes with a huge risk that is often overlooked.

In addition, is there much logic in having half a million in IRA of 401k investments if the investor also has a mortgage of three hundred thousand with interest and maintenance at eight or ten percent? In the case of the IRA and 401k, the investor is risking all of their savings, while only breaking even if the entire personal financial picture is taken into account.

Imagine instead a debt-free person that owns their home on the eve of the crash of 2008 and the following Great Recession. Nothing was lost in the financial crash, they have no mortgage to pay, and even if the person loses their job, a few thousand dollars will pay the property taxes for years in most locations.

Often in personal finance, investing in the stock markets is considered prudent, but at the same time, that person is carrying personal and mortgage debts that undermine the small yearly gains in the stock market. When markets crash, it is hard to watch as retirement dreams go up in smoke. But a person focused on paying down debt will not only survive the crash, but might have excess capital to buy assets that have suddenly become much cheaper and that no one wants anymore.

This is not to say that people should never invest in markets, as there are methods to invest without risking the entire portfolio or saving on various investments, but it would be a mistake to swallow the marketed Modern Portfolio Theory without understanding that through investment, a person is risking everything for a small yearly return.