tax benefits

-

Taxes

Work From Home Tax Deductions That You Can Claim

At home businesses have many advantages over their brick-and-mortar counterparts. For a start, entrepreneurs save money on gas and office rent. Similarly, freelancers that operate online enjoy unique benefits in comparison to employees who commute to a physical office location. However, transportation costs and rent are on the tax deductible expenses list of traditional businesses, but not digital ones. Nonetheless,…

Read More » -

Budgeting

Part Two: Inflation and Your Health Premiums

Generally, the government takes care of a portion of your health insurance premiums. The amount is based on someone’s income bracket, which changes every year because of inflation. In a previous article, we discussed how this impacts the average monthly health insurance cost, even if a household’s income doesn’t go up or down. The change will effect the 2019 Medicare…

Read More » -

Budgeting

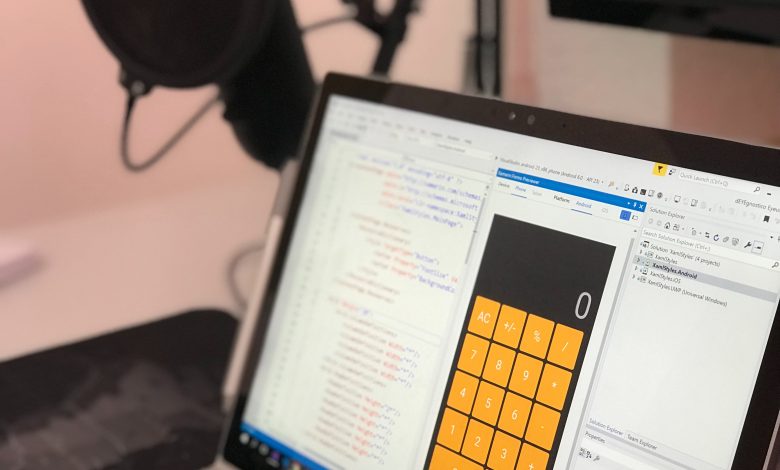

The Best Online Budgeting Tools for Taxes

In a previous article, we outlined the advantages of using online budgeting tools for your taxes. We also discussed how the IRS customer service team may offer free support and guidance. These different tax-preparation methods can save you plenty of money and time, while enabling you to discover new deductions and credits. Some of the most prominent apps include PocketGuard,…

Read More » -

Investing

Five Reasons to Invest in Real Estate

Investing in real estate means that you purchase a future income stream from a property. You probably don’t realize that you could be earning money at the same time as using renter’s money to pay off your investment. By doing this, you’ll get more stability, higher returns, and diversification. Investing in real estate is especially beneficial if you’re about to…

Read More »