Small Business

-

Budgeting

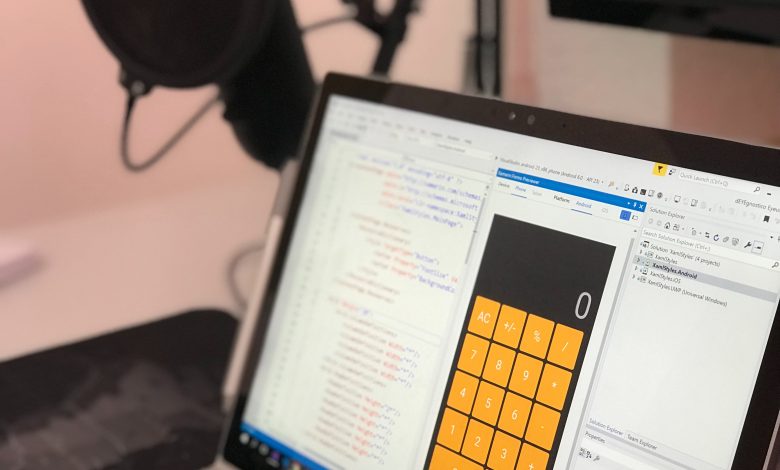

The Best Online Budgeting Tools for Taxes

In a previous article, we outlined the advantages of using online budgeting tools for your taxes. We also discussed how the IRS customer service team may offer free support and guidance. These different tax-preparation methods can save you plenty of money and time, while enabling you to discover new deductions and credits. Some of the most prominent apps include PocketGuard,…

Read More » -

Budgeting

The 2020 Inflation Adjustment and Your Health Premiums

Starting next year, inflation will impact the average monthly health insurance cost and the Medicare premiums 2020 rates. More specifically, even if your income doesn’t change, inflation might diminish your taxable earnings. In turn, you may qualify for lower premiums and tax savings. Having said that, higher health insurance options are also on the table. If your income increases, so…

Read More » -

Budgeting

The Hidden Burden of Sales Taxes

Imagine that you’re in line at the grocery store. As the cashier rings up the other customers’ items, their total payment and sales taxes show up on the register. Meanwhile, when it is your turn, the checkout employee deducts your taxes or refunds you the amount in cash. If you happen to live in one of the states with no…

Read More » -

Banking

Three Business Taxes for Small Businesses

Paying taxes is inevitable. Everyone has to do it, whether you want to or not. By preparing for tax season and having all of your documents from the year organized and ready to go, you’ll avoid any unnecessary stress that will prolong the tax process. As long as you already have an estimated amount of money set aside to pay…

Read More » -

Loans

Why You Should Take Out a Business Loan

You’ve finally tackled all of those startup obstacles and are running your own business. Your dream has become a reality, and you’ve become your own boss. You’ve sorted all of the logistics of a new company and are now looking to expand in areas like staffing, equipment, and location. This is when you might consider taking out a business loan.…

Read More »