Savings

-

Budgeting

Simple Tips for Saving

Read on for a few tips that can give you the start you need and help you ensure that the wealth you need is attainable.

Read More » -

Budgeting

The Best Savings Opportunities in 2020

When we entered 2019 one year ago, businesses and consumers, alike, were concerned about the economy. During that time, trade relations between the US and China escalated. In addition, the Federal Reserve hiked interest rates several times in 2018, with more increases planned for 2019. Just as importantly, the stock market plummeted and reached alarming lows. However, one year later,…

Read More » -

Budgeting

Automate It! Apps & Tools for Simple Saving

Everybody wants to save money. The thing is, it's not always easy. So what if you could automate your saving?

Read More » -

Investing

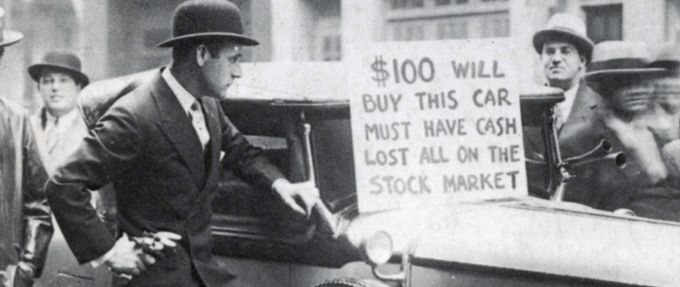

The Risks of Investing Your Life Savings

Common knowledge says that it is smart to invest your life savings in the markets. But is that really a good idea? Learn how Modern Portfolio Theory started.

Read More » -

Budgeting

How to Cope with Higher Gas Station Prices

Just as with any other product, the gas station prices that consumers pay to fill their cars depends on the cost of producing the fuel. More specifically, when petroleum, the original product that gas is derived from, becomes more expensive, so does the cost of transportation. In those situations, consumers may struggle to find cheap gas nearby them. Since early…

Read More » -

Budgeting

Part Three: Preparing for Inflation-Adjusted Premiums

In January, your tax credits and average health insurance cost, per month, are going to change. Whether it’s a private plan, an employer-sponsored one, or Medicare, all consumers’ income brackets are going to be adjusted for inflation. In short, if your household earnings go up, your premiums might not because of the higher income brackets. Moreover, consumers may even qualify…

Read More » -

Banking

Crypto Alternatives for Everyday Savings Tools

Remember when interest rates used to be high? Gone are the days of earning ten percent or more on a short-term certificate of deposit. Savers have long been high and dry when it comes to profitable places to stash their cash, while interest rates have been at rock bottom for years and other investments were too risky to keep savings…

Read More » -

Budgeting

Budgeting for Your Honeymoon

Planning a wedding is full of budgeting. You have to consider venues, food, music, clothing, and so much more. But it doesn't stop there. You also have to prepare for your honeymoon after your big day. There's some important aspects to remember when planning your costs for this, but there are also some tricks to help your budget go farther…

Read More » -

Budgeting

Part Two: Inflation and Your Health Premiums

Generally, the government takes care of a portion of your health insurance premiums. The amount is based on someone’s income bracket, which changes every year because of inflation. In a previous article, we discussed how this impacts the average monthly health insurance cost, even if a household’s income doesn’t go up or down. The change will effect the 2019 Medicare…

Read More » -

Banking

Banking with USAA: The Pros and the Cons

Based in San Antonio, the United Services Automobile Association (USAA) has been a banking go-to for many military families. They offer banking, investing, and insurance services to about 12.5 million members. Their banking service has existed since the end of 1983, and they had over $62.5 billion dollars in 2015. However, their benefits are a bit exclusive, offered only to…

Read More »