Small Business

Starting a new business can be tricky, but we can make the loan process easier. There are places that will loan you amounts to get your company started, but you can use a business loan at any point in your process of building or maintaining your business. RateRush.com has the inside scoop on when to apply, how much you need, and the best places to look at to ensure you’re running your business as efficiently as possible.

-

Exploring Term Loans for Small Businesses

When it comes to loans, there is really only one principal to remember that keeps the industry going. The bank has the money that you need. That is especially true if you are a small business looking to get started or get the boost that you need.

Read More » -

A Business Loan vs. Grant: Which One?

When looking for solutions, every business owner and entrepreneur knows that there is no one-size-fits-all approach. Each entity is unique, and their approach depends on their industry, size, business model, location, and structure. However, every company needs capital and funding in order to grow. Some firms are able to qualify for a private or federal small business grant. Others, meanwhile,…

Read More » -

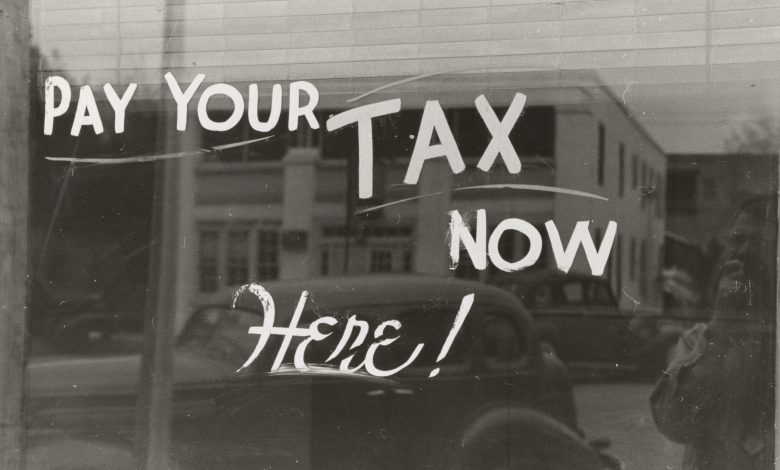

Three Business Taxes for Small Businesses

Paying taxes is inevitable. Everyone has to do it, whether you want to or not. By preparing for tax season and having all of your documents from the year organized and ready to go, you’ll avoid any unnecessary stress that will prolong the tax process. As long as you already have an estimated amount of money set aside to pay…

Read More » -

Why You Should Take Out a Business Loan

You’ve finally tackled all of those startup obstacles and are running your own business. Your dream has become a reality, and you’ve become your own boss. You’ve sorted all of the logistics of a new company and are now looking to expand in areas like staffing, equipment, and location. This is when you might consider taking out a business loan.…

Read More »