Tax Software

-

Taxes

A Guide to Doing Your Taxes

It is completely mandatory, but it can also be a somewhat intimidating and complex process.

Read More » -

Taxes

Work From Home Tax Deductions That You Can Claim

At home businesses have many advantages over their brick-and-mortar counterparts. For a start, entrepreneurs save money on gas and office rent. Similarly, freelancers that operate online enjoy unique benefits in comparison to employees who commute to a physical office location. However, transportation costs and rent are on the tax deductible expenses list of traditional businesses, but not digital ones. Nonetheless,…

Read More » -

Budgeting

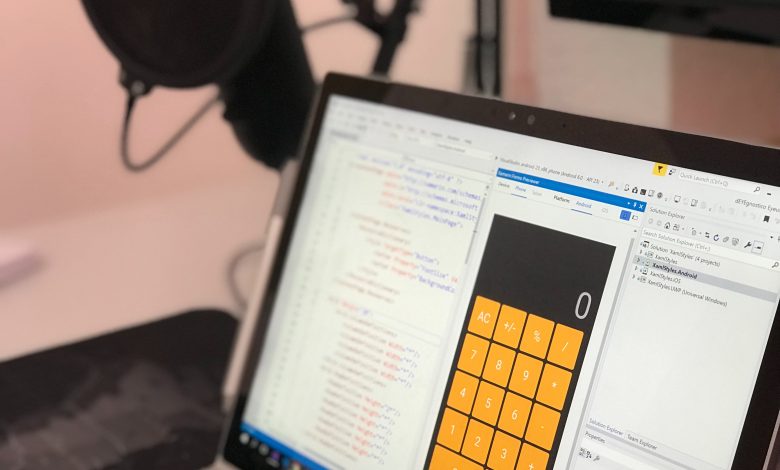

The Best Online Budgeting Tools for Taxes

In a previous article, we outlined the advantages of using online budgeting tools for your taxes. We also discussed how the IRS customer service team may offer free support and guidance. These different tax-preparation methods can save you plenty of money and time, while enabling you to discover new deductions and credits. Some of the most prominent apps include PocketGuard,…

Read More » -

Budgeting

Efficient Tax Planning: How and When You Should Do It

Two years ago, the Republican-controlled United States Congress passed the Tax Cuts and Jobs Act. The law, which President Donald Trump signed into effect, made filing taxes easier and simpler. Even more so when we consider the already existing online tax-preparation software, alongside some handy IRS customer service features. The picture, however, isn’t as rosy as it looks. In 2019,…

Read More »